KNEC FINANCIAL ACCOUNTING NOTES – MODULE I

KSh250.00

KNEC FINANCIAL ACCOUNTING NOTES – MODULE I

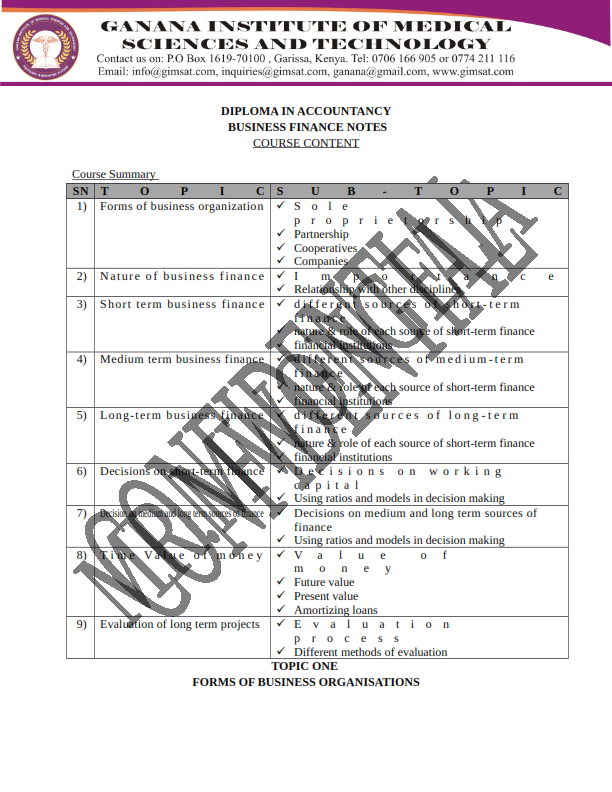

Course outline

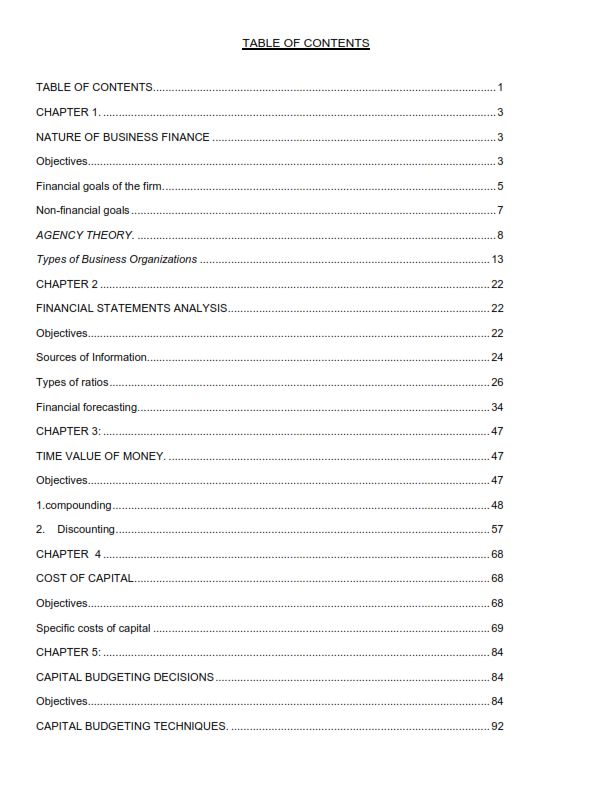

Introduction to accounting:

Definition of terms used in accounting

Users of accounting information

Information needs

Qualities of good accounting information

Nature of accounting equation

Effects of business transactions

The ledger and the trial balance

Definition of a ledger and an account

Importance of a ledger

Relationship between a ledger and an account

Classifications of ledgers

Nature of double- entry system

Definition of a trial balance

Importance of a trial balance

Balancing off of accounts

Definition of a trial balance

Importance of a trial balance

Types of errors and their correction

Types of errors that do not affect the agreement of a trial balance

Types of errors that do not affect the agreement of a trial balance

Types of errors that affect the agreement of a trial balance

Functions of suspense account

Corrections of errors using a

Source documents

Meaning of source documents

Types of source documents

Uses of source documents

Relationship between source documents and books of account

Books of original entry

Definition of books of original entry

Classifications of books of original entries

Preparation of books of original entry

Posting transactions from the books of original entry to the ledger

The cashbook

Definition of cashbook

Types of cashbook

Types of discounts

Recording transactions in a cashbook

Petty cashbook

Definition of petty cashbook

Imprest system

Purpose of petty cash

Preparation of petty cashbook

Bank reconciliation statements

Definition of bank reconciliation statements

Purpose of preparing bank reconciliation statements

Causes of the differences between bank statements and the cashbook balance

Steps/procedure in preparing bank reconciliation statement

Control accounts

Definition of control accounts

Uses of control accounts

Preparation of control account

Accounting concepts, conventions and bases

Definition of accounting concepts, conventions and bases

Types of accounting concepts, conventions and bases

Capital and revenue expenditure

Definition of capital and revenue expenditure

Double entry system for revenue and capital expenditure

Classification of expenditure

Adjustments to final accounts

Meaning of final accounts

Purpose of final accounts adjustment

Procedure of making adjustments in final accounts

Accounting for fixed assets

Definition of depreciation

Causes of depreciation

Reasons for providing for depreciation

Methods for providing for depreciation

Double entry for depreciation.

Accounting for disposal of fixed assets

The fixed asset movement schedule

Final Accounts for sole-proprietorship

Definition of final accounts

Types of final accounts

Preparation of final accounts

Non-Profit Making Organizations

Definition of Non-profit making Organization

Differences between Receipts and payment accounts

Relationship between Income and Expenditure accounts

Preparation of final accounts of Non-profit making Organizations

Emerging Trends and Issues in Financial Accounting

Emerging trends and issues in financial accounting

Challenges posed by emerging trends and issues in financial accounting

Coping with the challenges posed by emerging trends and issues in financial accounting to managing emerging financial issues

FILE FILE PAGES: 158

FILE FORMAT:PDF