BAC 822: Entrepreneurial Finance Notes – Kenyatta University

KSh250.00

Institution: Kenyatta University

Course: Master of Business Administration

Pages: 136

File: PDF

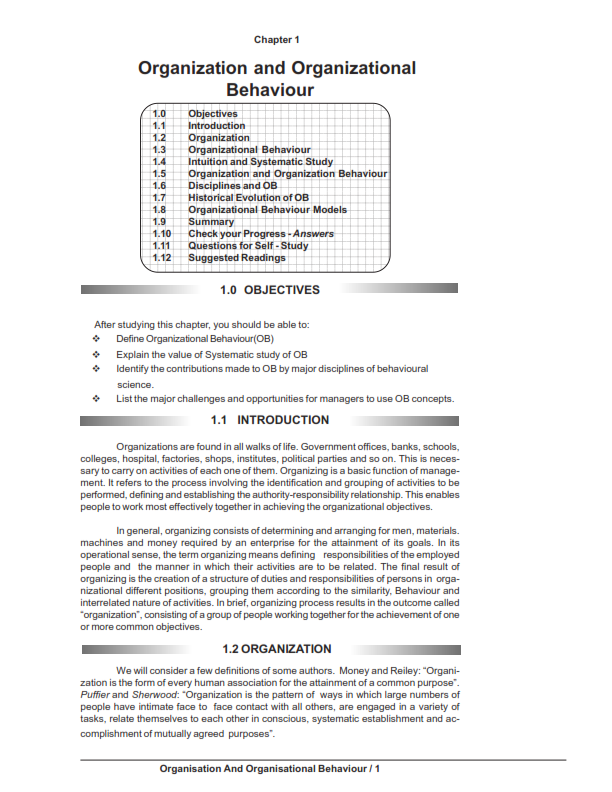

TABLE OF CONTENTS

1.0 Introduction…………………………………………………………………………………………………1

Characteristics of small businesses at each stage of development……………………………….8

History of venture capital. …………………………………………………………………………………37

4.8 THE MONEY MARKET …………………………………………………………………………….58

The analyst’s perspective…………………………………………………………………………………..65

5. 4 Business Valuation methods………………………………………………………. 67

5.5 Cash Flow Calculation ……………………………………………………………….. 73

Investment cash flow………………………………………………………………………………………..75

Financing cash flow………………………………………………………………………………………….76

PROPULSION PLE. ………………………………………………………………………………………77

Net cash inflows from operating activities……………………………………………………………78

Net cash flow from returns on investment…………………………………………………………….78

and servicing of finance…………………………………………………………………………………….78

Taxation………………………………………………………………………………………………………..78

Net cash outflow for taxation……………………………………………………………………………..78

Capital expenditure ………………………………………………………………………………………..78

Net cash outflow for capital expenditure………………………………………………………………78

Equity dividends…………………………………………………………………………………………….78

Net cash outflow for capita; expenditure………………………………………………………………78

Management of liquid resources………………………………………………………………………78

Net cash inflow from management of liquid …………………………………………………………78

Resources……………………………………………………………………………………………………….78

Financing ………………………………………………………………………………………………………78

Net cash outflow for financing……………………………………………………………………………78

5.7 Financial Ratios ………………………………………………………………………… 79

Important financial ratios………………………………………………………………………………….81

5.8 Working Capital Needs……………………………………………………………… 83

Important calculations under working capital. ……………………………………………………..83

5.9 Sales Volume Breakeven Analysis……………………………………………….. 84

Important calculations under break even analysis…………………………………………………84

5.10 Credit Assessment……………………………………………………………………. 85

Important calculations in credit assessment………………………………………………………….85

5.11 Inventory Analysis. ………………………………………………………………….. 86

Important calculations for inventory analysis. ………………………………………………………86

6.8 Working of the stock exchange………………………………………………….. 89

MARKET MAKERS………………………………………………………………………………………90

6.1 What is ‘to go public’? ………………………………………………………………………………..91

Public company management team ……………………………………………………. 95

The board of directors……………………………………………………………………… 96

6.8 Working of the stock exchange ……………………………………………………. 99

MARKET MAKERS………………………………………………………………………………………99

iii

Nairobi Stock Exchange Today…………………………………………………….. 100

FINANCIAL MANAGEMENT………………………………………………………. 102

7.1 COMPANY OBJECTIVES ………………………………………………………. 102

7.3 FINANCIAL OBJECTIVES……………………………………………………………………….104

Growth of institutional investment…………………………………………………………………….106

8.2 The cost of equity capital ………………………………………………………….. 111

General approach to the cost of capital ………………………………………………………………111

Analytical approaches to calculating the cost of capital…………………………………………112

8.3 Dividends……………………………………………………………………………….. 112

Dividends growth model: ………………………………………………………………………………..112

8.4 Cost of retained earnings…………………………………………………………… 114

8.5 Cost of preference share capital………………………………………………….. 114

COST OF LONG TERM DEBT……………………………………………………… 114

8.7 cost of other forms of borrowing………………………………………………… 116

Capital cost of new issues………………………………………………………………………………..116

8.8 The efficient market hypothesis…………………………………………………………………..117

A Perfect Market ……………………………………………………………………………………………117

Random Walk ………………………………………………………………………………………………. 118

The Efficient Market Hypothesis………………………………………………………………………118

The Semi-Strong form of the EMH……………………………………………………………………119

The Strong Form of the EMH…………………………………………………………………………..120

8.9 Implications of the EMH for financial management………………………………………..121

LESSON SEVEN …………………………………………………………………………. ………………122

HARVESTING A BUSINESSS …………………………………………………………………………122

8.2 Why would a business be harvested? ………………………………………….. ……………122

Changes in personal situations…………………………………………………………………………123

Retirement…………………………………………………………………………………………………….123

Case illustration……………………………………………………………………………………………..123

Relocation …………………………………………………………………………………………………….124

Change in life cycle ………………………………………………………………………………………..124

Stress……………………………………………………………………………………………………………124

Other interests……………………………………………………………………………………………….125

Passing on the business to the other family members. ……………………………………….126

Direct Sale…………………………………………………………………………………………………….127

Employee Stock Option Plan ……………………………………………………………………………127

Leveraged Buyout…………………………………………………………………………………………..129

How does a leveraged buy out work? ……………………………………………………………..129

Advantages of a leveraged buy out …………………………………………………………………130

Disadvantage ……………………………………………………………………………………………….130

Advantages of a merger…………………………………………………………………………………130

Going public………………………………………………………………………………………………….131

8.4 LIQUIDATION………………………………………………………………………………………..131

Related products

School of Business

BMS 841: Management Information Systems Notes – Kenyatta University

School of Business

HBC 2214: Procurement and Logistics Management Notes – JKUAT

School of Education Science

SMA 160: Probability and Statistics I Notes – Kenyatta University

School of Business

School of Business

School of Education Arts

AHT 419: Science and Technology Since 1500 CE Notes – Kenyatta University

Business Plan

School of Business