ATD Level I – Financial Accounting Study Notes

KSh399.00

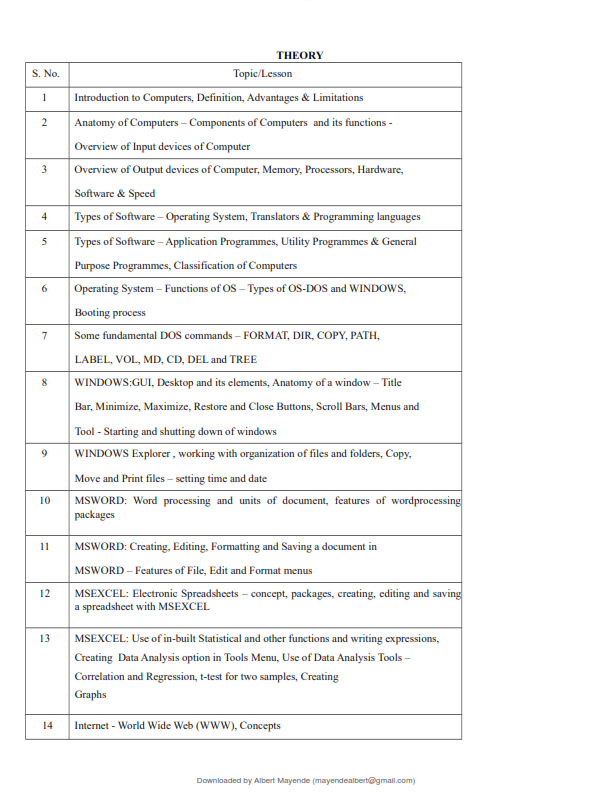

ATD LEVEL 1 – INTRODUCTION TO FINANCIAL ACCOUNTING NOTES

Topics Covered In

Topic 1: Introduction to accounting

Topic 2: Double entry bookkeeping and books of original entry including Manual and computerized systems

Topic 3: Accounting for assets and liabilities

Topic 4: Correction of accounting errors and the suspense account

Topic 5: Financial statements of a sole trader

Topic 6: Partnership accounts

Topic 7: Company accounts

Number of Pages:287

File Format: PDF

Related products

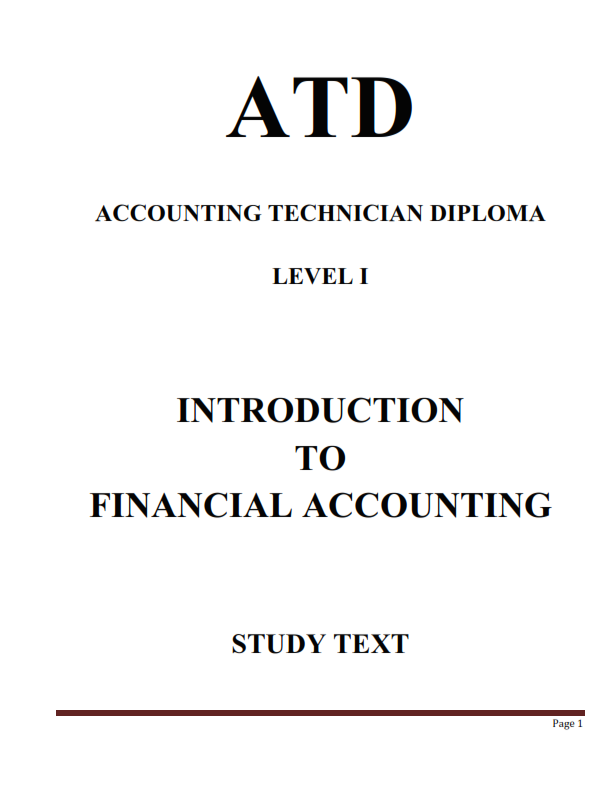

CPA SECTION 5

Advanced Management Accounting Topics covered include:

Topic 1: Nature of management accounting

Topic 2: Decision theory

Topic 3: Cost estimation and forecasting

Topic 4: Inventory control decisions

Topic 5: Pricing decisions

Topic 6: Short-term planning and decision-making

Topic 7: Budgetary control and advanced variance analysis

Topic 8: Performance measurement and evaluation

Topic 9: Environmental management accounting

Number of Pages:295

File Format: PDF

CCP SECTION 4

MANAGEMENT INFORMATION SYSTEMS

Topics Covered:

Topic 1: Introduction to information communication technology(ICT)

Topic 2: ICT governance

Topic 3: Systems development

Topic 4: Information systems in an enterprise

Topic 5: Enterprise data Management

Topic 6: Data communication and computer networks

Topic 7: E-commerce

Topic 8: Information systems strategy

Topic 9: Information systems risk and security management

Topic 10: Legal, ethical and social issues in management information system

Topic 11: Emerging issues and trends

NUMBER OF PAGES:345

FILE FORMAT:PDF

ATD Notes

ATD& DCM AUDITING NOTES

Auditing Topics covered are:

Topic 1: Nature, purpose and scope of auditing

Topic 2:Legal and professional requirements

Topic 3: Planning and conducting an audit

Topic 4: Internal control system

Topic 5: Error and fraud

Topic 6: Audit evidence

Topic 7: Audit Risk

Topic 8: Computerized auditing

Topic 9: Auditor’s report

Topic 10: Emerging issues and trends

Number of Pages: 200

File Format: PDF

ATD LEVEL 3

FUNDAMENTALS OF MANAGEMENT ACCOUNTING NOTES

Topics Covered:

Topic 1: Nature and purpose of cost and management accounting

Topic 2: Cost classification

Topic 3: Cost estimation

Topic 4: Cost accumulation

Topic 5: Cost bookkeeping

Topic 6: Costing methods

Topic 7: Marginal and absorption costing

Topic 8: Budgeting and budgetary control

Topic 9: Emerging issue and issues

Number og Pages:258

File Format: pdf

CPA ADVANCED LEVEL (SECTION 6) – ADVANCED PUBLIC FINANCE AND TAXATION NOTES

Topics covered include:

Topic 1: External resource financing

Topic 2: Public Investments

Topic 3: Public Private Partnerships arrangements

Topic 4: Public debt management

Topic 5: Advanced aspects of the taxation of business income

Topic 6: Tax administration and investigations and enforcement department

Topic 7: Taxation of cross border activities

Topic 8: Tax planning

Topic 9: Tax systems and policies

Topic 10: Professional practice in taxation

Number of Pages: 205

File Format: PDF

CIFA Notes

SECTION 3

FINANCIAL REPORTING NOTES

Topics covered in details:

Topic 1: Assets of financial statements

Topic 2: Liabilities of financial statements

Topic 3: Further aspect of partnerships

Topic 4: Special transactions

Topic 5: Financial statements for various types of businesses

Topic 6: Published financial statements

Topic 7: Consolidated financial statements

Topic 8: Financial statements under IPSASs

Number of Pages:371

Information Communication Technology Notes

covered in this ICT unit are as follows::

Topic 1: Introduction to ICT

Topic 2: Computer systems

Topic 3: Computer hardware

Topic 4: Computer software

Topic 5: Introduction to operating systems

Topic 6: Computer files

Topic 7: An overview of application

Topic 8: Overview of information systems

Topic 9: Computer networks

Topic 10: The Internet

Topic 11: Emerging issues and trends

Number of pages:209

File:Format:PDF

Kasneb Resources